Simplify Your Oversize/Overweight Loads

- Instantly Determine Permit & Escort Costs

- Calculate Max Legal/Permitted Axle Weights

- Understand Equipment Limits

Trip Permits - IRP Permit - The International Registration Plan Permits

The International Registration Plan (IRP) is a reciprocal registration agreement between the contiguous (“lower 48”) United States and the ten Canadian provinces that provides equitable “apportioned payments” of registration fees. Each jurisdiction (state or province) has the responsibility of issuing IRP registrations for operators in its state, consequently, each state has its own IRP agency and its own guidelines and forms for submitting the IRP applications and annual filings.

Once registered, your truck may operate in all other member jurisdictions. If, however, your truck operates only between two states, then the registration fee collected is shared between only those states based on the states’ registration fees for your vehicle, and the number of miles driven in each state. These registration fees are collected every 12 months, when you renew your registration in your home jurisdiction. The goal of the IRP is to balance the registration fees across all jurisdictions involved—based on miles drive in each jurisdiction—since the states use those fees as part of their highway maintenance programs.

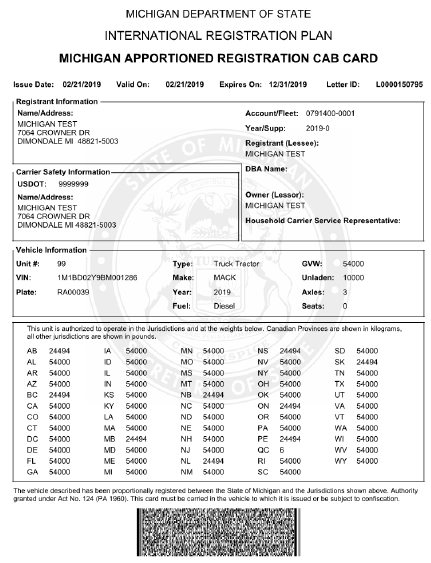

Under this program, an interstate carrier files an apportioned registration application in the state or province where the carrier is based (the base jurisdiction). The vehicle and the miles traveled in each state are listed on the application. The base jurisdiction collects the full license registration fee and distributes a portion of it to the other jurisdictions based on the percentage of miles the carrier has traveled in each jurisdiction. The base jurisdiction issues a license plate showing the word "APPORTIONED" and a cab card showing the weights for which the carrier has paid fees in all IRP member jurisdictions.

The apportioned plate and the cab card are the only registration credentials needed to operate in member jurisdictions. The registration credentials allow the carrier to operate both intrastate and interstate in all IRP jurisdictions. All member jurisdictions are automatically displayed on the cab card. This is done to simplify the registration process and provide flexibility for registrants.

One of the more confusing aspects of IRP for new members is the “Average Per Vehicle Distance” (APVD) calculation. Since IRP fees are based on the distance traveled within each jurisdiction, a new applicant has no established history of miles driven in any jurisdiction. New applicants must use the APVD calculation for the first year of filing.

The APVD calculation is based on the average distance vehicles from your jurisdiction traveled to all other IRP member jurisdictions during the previous calendar year (Example: Missouri XLSX). These data are used to calculate your IRP fee. In subsequent years, you will report the actual miles logged in each jurisdiction for your registration year. Note, the APVD computations are different for each state—it is important to use the APVD for your home jurisdiction.

Like IFTA, when filing the annual IRP registration fees, the operator must include the mileages driven in each jurisdiction, in this case for the 12 months covered by the filing, so that the registration fees can be distributed proportionately to each state in which the vehicle was operated.

This simplifies the filing process for each operator. Although mileage for each state must be reported, the operator writes only one check and files one registration per year. Operators are expected to keep monthly mileage records showing miles driven in each jurisdiction for the 12-month registration period.

An “Apportionable Vehicle” is “any Power Unit that is used or intended for use in two or more Member Jurisdictions and that is used for the transportation of persons for hire or designed, used, or maintained primarily for the transportation of property,” and:

Once your registration application is processed, you will be issued the special license plate marked “Apportioned,” “APP” or “PRP,” depending on your home jurisdiction, and you will be issued, and are required to keep, a Cab Card in the cab. Note that the IRP registration authorizes you to operate in any and all other jurisdictions with no additional applications for routine operations (i.e., it does not authorize operations such as oversize or overweight loads).

To determine the apportioned percentage of any given jurisdiction, divide the mileage driven (“Distance”) in the jurisdiction by the total mileage driven over the 12 month period covered in the filing (see Example table below). Multiply the apportioned “Percentage” by the respective jurisdiction’s “Annual Fee” to calculate the cost per vehicle.

Example: Cost Per Vehicle (or Fleet) | ||||

| Jurisdiction | Annual Fee1 | Distance | Percentage2 | Cost |

| A | $810.00 | 20,634 | 25% | $202.50 |

| B | $1,750.00 | 14,856 | 18% | $315.00 |

| C | $1,200.00 | 18,158 | 22% | $264.00 |

| D | $2,100.00 | 28,888 | 35% | $735.00 |

| Totals | -- | 82,536 | 100% | -- |

| Total Due | | | | $1,516.50 |

| 1Fees may change over the 12-month period; use the 12-month sum of monthly or quarterly fees to determine the annual fee. Current fees by state may be found at https://www.irponline.org/page/FeeSchedules#M 2 Multiply the Annual Fee by the Percentage (for example, 0.25 x $810.00 for Jurisdiction A) to determine actual fee for that jurisdiction ($202.50). Repeat this process for each Jurisdiction. Note: Long-distance OTR operations will involve many, perhaps most jurisdictions. Calculations for each jurisdiction traveled in or through are required. | ||||

Apportioned registration is based on several factors, and as a result, the cost varies. All IRP jurisdictions charge annual registration fees according to the weight, and in some instances, other factors such as the vehicle age, axles, ad valorem taxes, etc. As each jurisdiction's fees are determined by its legislative branch, a jurisdiction's fees may change at any time. The actual fee for any jurisdiction is a combination of the jurisdiction fee and the percentage of the number of miles driven in that jurisdiction.

Each year the operator is required to report the total distance per jurisdiction for a specified 12-month period, indicating actual distances driven in each of those jurisdictions. Depending upon your base jurisdiction, there may be additional administrative fees for plates, cab cards, etc. Also note that some states require the original cab card to be carried in the vehicle, while other states will accept either a copy or an electronic copy.

Trip And Fuel Permits By State

Frequently Asked Questions

Q. What is the difference between IRP and the International Fuel Tax Act (IFTA).

A. The IRP apportions Registration Fees across jurisdictions while the IFTA apportions only Fuel Taxes. IRP fees are due annually in the month specified by the state IRP agency.

Q. What jurisdictions are members of the IRP?

A. There are a total of 59 jurisdictions that participate in IRP. The continental 48 states, the District of Columbia, and 10 Canadian Providences (AB, BC, MD, NB, NL, NS, ON, PE, QC, SK).

Q. What state can I register my vehicle(s) in?

A. You will register your vehicle in your base jurisdiction or as defined in the IRP Agreement, the jurisdiction where you have an “Established Place of Business.”

Q. How much will the IRP fee cost me?

A. There are several variables that will affect the IRP fee, but as an example, a vehicle registered in all jurisdictions at a weight of 80,000 lb. will be charged a fee of approximately $2,000 for 12 months. Note, this is an estimate only, your mileage for each jurisdiction must be reported, transaction must be processed, and an invoice prepared before an exact fee can be determined.

Q. How long will it take to receive my IRP Plate?

A. Once your application is received, it will take the state 3-5 days to prepare the invoice for you apportioned plates. When the invoice is issued, your plates and Cab Card are ready. They will be sent out within 3-5 days after receipt of payment of the invoice.

Q. May I pay my IRP invoice with a credit card?

A. Not all jurisdictions accept credit card payments. Contact your base jurisdiction's website to inquire whether or not they accept credit card payments.

Q. What if I must withdraw from the IRP Plan for a period of time?

A. If a motor carrier is out of the IRP Plan for 18 months the application to rejoin is treated as a new application and the operator is required to use the Average Per Vehicle Distance Chart miles. If the operator is out for fewer than 18 months, the application will be treated as a renewal.

Q. Do I need to keep track of my miles?

A. The answer is “yes.” You must record all jurisdictional miles traveled (even if you are leased to a carrier that take care of your IFTA. The mileage records must be submitted as part of your IRP renewal and, are be required in the event of an IRP audit.

Q. When do my plates renew?

A. Plates renew annually at different times of the year based on your state requirements. The expiration date for your registration is printed on your Cab Card. You should receive a renewal notice approximately two months before the expiration date. If you have not received a renewal notice within 45 days of the expiration date, contact your state IRP office. It is the operator’s responsibility to ensure that registration and plates are renewed before they expire.

Q. May I use a third-party service provider to manage my IRP paper work and filings.

A. Yes, a service provider may handle all motor carrier's paperwork. Operators should be aware that there may be specific requirements for service providers in each jurisdiction. These agencies or services may perform the calculations for you, but make sure that these services have agents in the states in which you travel. Some IRP offices may not accept submission from out-of-state agents. It is important that you consult jurisdictional requirements to ensure that the service provider is recognized or acceptable. Ultimately, all filings are the responsibility of the operator.

Q. As an IRP-registered operator, must I still have to a US Department of Transportation (DOT) number?

A. Yes, a commercial vehicle with a GVW in excess of 10,000 pounds, if leaving the base jurisdiction must have a US DOT number.

Q. What is a Hunter’s Permit?

A. The International Registration Plan Hunter's Permit states, "Each member jurisdiction shall provide a means of temporary registration of unladen apportionable vehicles to allow the owner/operator to look for work. Such registration shall be issued for a minimum fee and for a registered gross weight not in excess of the empty weight for the vehicle or combination of vehicles being registered. The evidence of registration issued under this section shall be valid in all member jurisdictions." Some states charge no fee for the Hunter Permit.

IRP Information

For more information on apportioned registration, go to the IRP, Inc. website www.irponline.org . The IRP website has a section specifically for motor carriers. Resources include a short video designed for motor carriers that explains IRP and record keeping.

See Also

Axle weight regulations by state